Contribution Margin Per Unit Formula

The contribution ratio can then be calculated by dividing the CM by the selling price per unit times the number of units sold. Use the sales mix formula.

Unit Contribution Margin Meaning Formula How To Calculate

Thus a break-even short cut is.

. Now lets try to understand the contribution margin per unit with the help of an example. For example if we want to accumulate a profit of 500 and earn a contribution of 5 per unit we must sell at least 100 units to meet our target. Profit Margin Profit Sales Price.

Contribution Margin Per Unit Per Unit Selling Price Per Unit Variable Cost. Find out the contribution contribution margin per unit and contribution ratio. Profit Sales Price Cost of Materials.

In terms of computing the amount. Again this is your sales price per unit minus your variable costs per unit. Formula for Contribution Margin.

The last calculation using the mathematical equation is the same as the breakeven sales formula using the fixed costs and the contribution margin ratio previously discussed in this chapter. Contribution margin per unit formula would be Selling price per unit. The company has net sales of 300000.

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. Breakeven point in units. Budgeted sales revenue for the next period is 1250000 in the standard mix.

COGS Per Unit is calculated using the formula given below. Next find your contribution margin ratio. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

Contribution Margin Net Sales Revenue Variable Costs. COGS Per Unit COGS Number of Units Sold. Definition Example and Formula for How to Calculate.

The number of units sold was 50000 units. Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales. Or the total is divided by contribution margin per unit to determine the required sales level in units.

For every two batches of balls sold one racquet is sold. Budgeted fixed costs are 407000 per period. We can represent contribution margin in percentage as well.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Here we discuss the calculation of gross margin and its percentage using formula along with examples. It is possible to jump to step b above by dividing the fixed costs by the contribution margin per unit.

The variable cost per unit is 2 per unit. Break-Even Point in Units Total Fixed Costs Contribution Margin Per Unit 1000 Units 1200000 1200. Divide the fixed costs by the contribution margin.

Without further ado heres the break-even formula. To calculate the variable contribution margin for a product or service follow the steps below. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

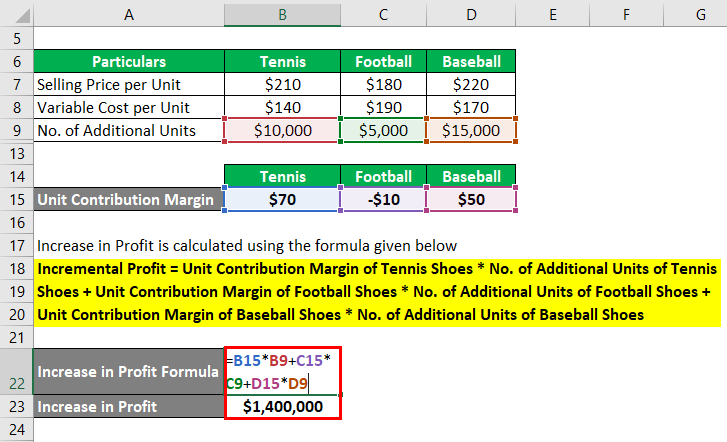

Sales Mix Variance Actual Unit Sales x Actual Sales Mix Percentage Planned Sales Mix Percentage x Planned Contribution Margin Per Unit. To determine your optimal approach you have to do some basic sales mix accounting. Find the product or services sale price.

Racquets sell for 4 per unit and have a unit variable cost of 260. Contribution Margin 50 25 Contribution Margin 25. Time Value of Money Formula.

Sometimes one may want to know the break-even point in dollars of sales rather than units. To calculate the Margin of Safety the following six steps must be followed. It can be calculated on an aggregate basis or a per unit basis and contribution margin is reported on a dollar basis.

Contribution Margin Definition A contribution margin is defined as the difference between the revenue generated by. COGS Per Unit 170000 2000. Break-even Point Per Unit Fixed Costs Sales Price Per Unit.

Break-Even Point Units Fixed Costs Revenue per Unit Variable Cost per Unit When determining a break-even point based on sales dollars. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. Performing this calculation can help you better understand the concept and its various uses.

The contribution margin is determined by subtracting the variable costs from the price of a product. Now that you understand the variable margin and its formula you can start calculating the margin for your business. This amount is then used to cover the fixed costs.

Guide to gross margin formula. Skip to primary navigation.

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin Ratio Revenue After Variable Costs

Contribution Margin Formula And Ratio Calculator

Contribution Margin Ratio Formula Per Unit Example Calculation

0 Response to "Contribution Margin Per Unit Formula"

Post a Comment